Medicare Supplement Plans (Medigap)

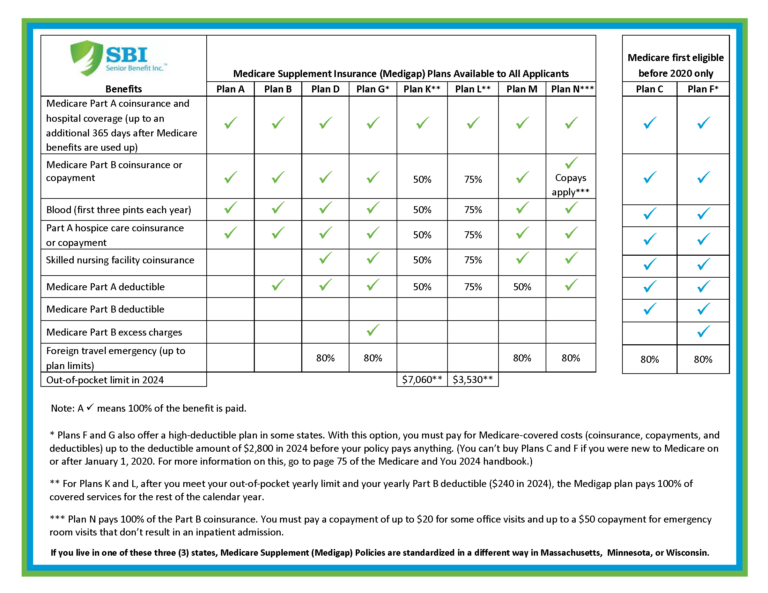

Medicare Supplement Plans are also known as Medigap Plans. These plans are designed to help you fill the gaps in Medicare leaves behind such as deductibles and co-insurance. With several different types of plans, these are available in all states.

When you are new to Medicare it can get overwhelming and many are surprised to learn Medicare only covers 80% of your Part B expenses while you are expected to cover the other 20% out-of-pocket. If a serious illness were to come about having to worry about the 20% you need to pay can be unexpected, confusing, and scary. Luckily you can choose a Medicare Supplement Plan that can cover some or all of that existing 20%. Medicare supplement plans supply you with peace of mind when you may be going through other things.

During your Initial Enrollment Period, you are guaranteed the right to purchase a Medicare Supplement Plan. Your health status will not affect you buying a plan during this seven-month period.

What is Medicare Supplement Insurance?

Medicare Supplements came into existence along with Medicare because from the beginning individuals were required to pay the existing 20% that Original Medicare would not be covering. Supplement plans were created to provide financial relief when it comes to covering that 20%.

Some of the benefits of Medicare Supplement Plans are:

- Freedom to choose your doctor and practice (no networks)

- Your primary doctor does not have to refer you to a specialist

- Coverage anywhere that Medicare is accepted

- Once you are accepted an insurance company can not drop you or change your coverage because of a health condition

Other important things to keep in mind when purchasing a Medicare Supplement Plan:

- You must already have Original Medicare (Part A and Part B) in order to purchase a supplement.

- Supplement plans do not cover a family just one individual.

- You can drop or change your supplement plan at any time.

- Many carriers offer a household discount when more than one person is enrolled in Medicare.

- Medicare Supplement Plans DO NOT include Part D (Medicare Drug Coverage).