Medicare Supplement Plans (Medigap)

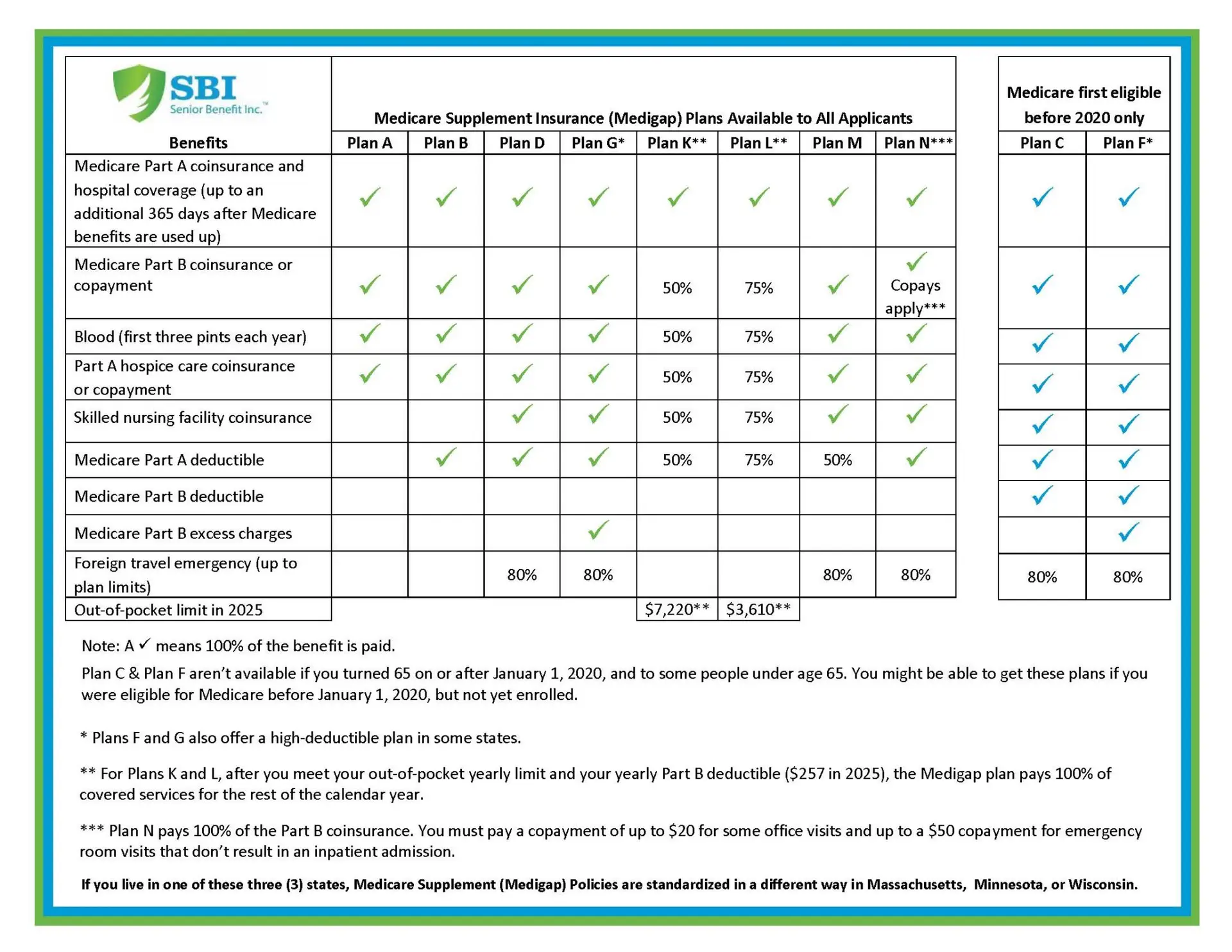

Medicare Supplement Plans, also known as Medigap, are essential for filling the gaps in Medicare coverage that can lead to out-of-pocket expenses and additional financial strain. These plans come in various types and are available in all states. With Medicare covering only 80% of Part B expenses, having a supplement plan covering some or all of the remaining 20% is crucial. In addition to financial benefits, a supplement plan provides peace of mind during challenging times such as unexpected medical emergencies or hospital stays. By choosing a Medigap plan, you can ensure that you have comprehensive healthcare coverage and protection against unexpected expenses. Therefore, it’s highly recommended to explore your supplement plan options and make an informed decision that best fits your unique healthcare needs.

Understanding Medicare Supplement Plans

Medicare Supplement Insurance is a great way to enhance your healthcare coverage. As we age, medical expenses can start to add up and become overwhelming. That’s where Medicare Supplement Insurance comes in: It covers the 20% of medical costs that Original Medicare does not. Supplement plans provide financial relief and benefits such as the freedom to choose your doctors and receive coverage anywhere Medicare is accepted. You can relax, knowing that your health is well taken care of.

But that’s not all! Once enrolled in a Medicare Supplement Insurance plan, insurance companies cannot drop or modify your coverage due to any health conditions you develop. You can relax and have peace of mind with consistent healthcare coverage when needed.

Supplement plans are a fantastic way to ensure you have the financial aid you need to help cover anything Original Medicare doesn’t. Don’t let medical expenses get the best of you – enroll in a Medicare Supplement Insurance plan today!

When purchasing a Medicare Supplement Plan, it’s important to keep the following in mind:

- You must have Original Medicare (Part A and Part B) before purchasing a supplement plan.

- Supplement plans cover only one individual, not a family.

- You can drop or change your supplement plan at any time.

- Some carriers offer a household discount when more than one person is enrolled in Medicare.

- Medicare Supplement Plans DO NOT include Part D (Medicare Drug Coverage).

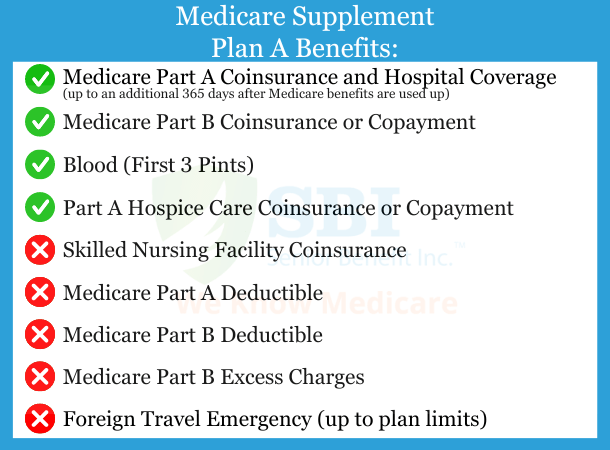

Understanding Medicare Supplement Plan A

Medicare Supplement Plan A is a fundamental benefit plan that all companies must offer per the Medicare Supplement guidelines. Although it may not have as many benefits as other plans, it still covers 20% of crucial outpatient medical care that Original Medicare does not cover, making it an essential choice for many beneficiaries. With Plan A, you can have peace of mind knowing that your medical expenses will be covered with minimal out-of-pocket costs, allowing you to focus on your health and well-being. Moreover, the plan’s simplicity makes it easy to understand and navigate, making it an excellent option for those who value clarity and straightforwardness in their healthcare coverage. Overall, Plan A is a reliable and beneficial option that can provide excellent coverage for those looking for affordable Medicare Supplement plans.

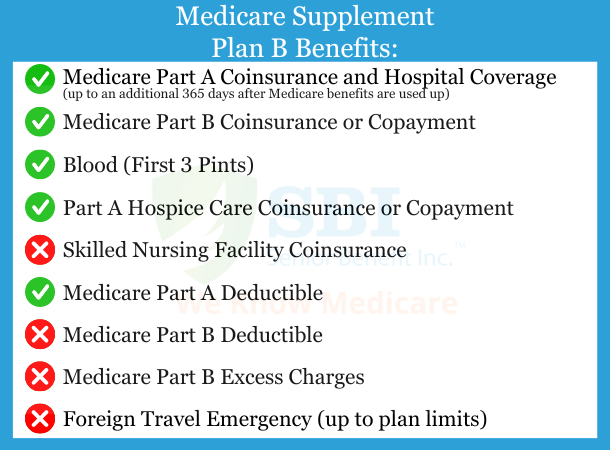

Understanding Medicare Supplement Plan B

Medicare Supplement Plan B is an excellent option for seniors who want comprehensive coverage to supplement their traditional Medicare coverage. With Plan B, you are covered for coinsurance on two essential parts of Medicare – Part A and Part B. Not only that, but it also includes coverage for hospice care copayments and three pints of blood per year.

That’s not all; Plan B also offers coverage for the Part A deductible, which can be costly without insurance. One great advantage of this plan is that it has no networks, meaning you can easily access medical care from any Medicare-approved facility. And since it’s widely accepted, you can be sure that you’ll be able to receive the care you need without any unnecessary hassle.

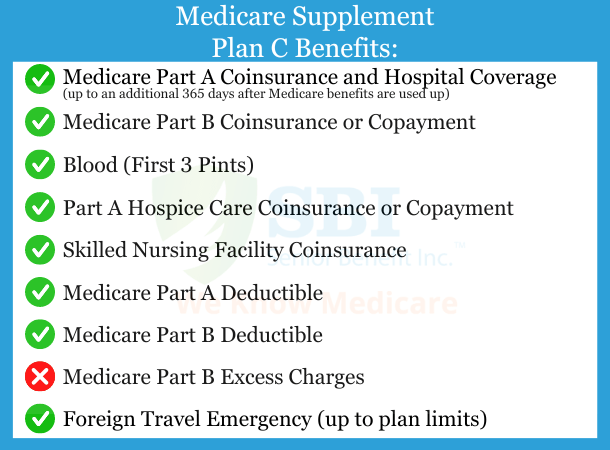

Understanding Medicare Supplement Plan C

Medicare Supplement Plan C is a comprehensive and highly beneficial plan for anyone seeking additional coverage to meet their healthcare needs. This plan covers most of your hospital and outpatient deductibles, coinsurance, and other expenses, making it an attractive option for individuals looking to save money on medical costs. Moreover, Plan C is an excellent choice for people who frequently travel overseas as it offers coverage for foreign travel emergencies up to plan limits.

Without a doubt, Medicare Supplement Plan C provides extensive medical benefits for policyholders. However, it is essential to note that this plan does not cover Part B excess charges. Despite this limitation, this plan can be used at any facility that accepts Medicare, and no networks restrict the policyholder’s freedom of choice concerning hospitals or doctors.

It is important to mention that Medicare Supplement Plan C is a popular choice for those seeking maximum coverage and paying higher premiums. It is especially beneficial for individuals with multiple health issues or who require frequent medical attention. However, it is essential to remember that not everyone can purchase this plan, as those who received Medicare Part A after January 1, 2020, are not eligible.

In conclusion, Medicare Supplement Plan C is an excellent option for anyone seeking comprehensive coverage to meet their healthcare needs. With its extensive benefits and flexibility in choosing healthcare providers, it is no wonder that this plan is a popular choice among Medicare beneficiaries.

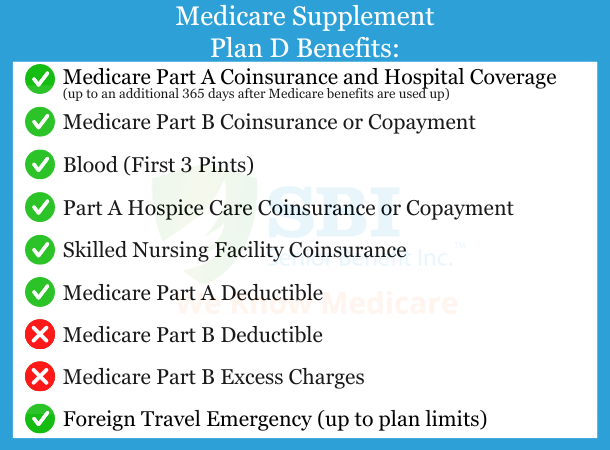

Understanding Medicare Supplement Plan D

Medicare Supplement Plan D is an excellent option for those seeking comprehensive hospital and medical expenses coverage. This plan also covers specific international travel emergencies, making it an ideal choice for frequent travelers. However, it’s important to note that Plan D does not cover your Part B deductible or excess charges. If you require frequent medical treatment, you might want to consider other plans that can provide additional coverage for these costs.

Despite these limitations, Plan D is a popular and highly recommended option for those seeking enhanced Medicare coverage. One great advantage of this plan is that it has no networks, meaning you can easily access medical care from any Medicare-approved facility. And since it’s widely accepted, you can be sure that you’ll be able to receive the care you need without any unnecessary hassle.

So, if you’re looking for a reliable and comprehensive Medicare supplement plan, consider Plan D. With its broad range of benefits and flexibility, it’s a top choice for many seniors and retirees!

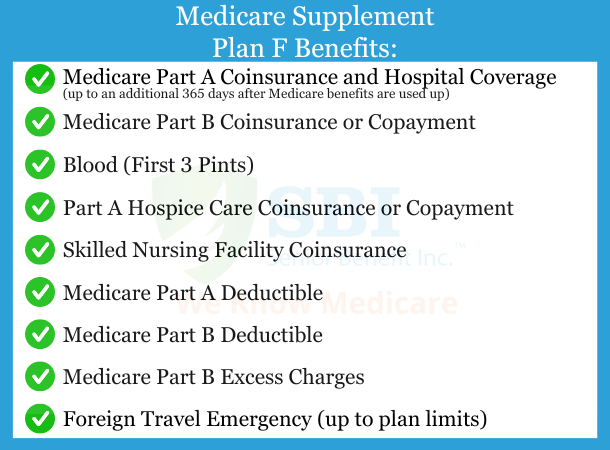

Understanding Medicare Supplement Plan F

Medicare Supplement Plan F is widely recognized as the most comprehensive plan available. It offers extensive coverage that ensures subscribers won’t receive additional bills beyond their monthly premium payment. This plan is thorough, covering all your medical expenses, so you won’t have to worry about networks, copayments, or deductibles. It’s the ideal solution for people who want peace of mind regarding healthcare costs.

It is important to note that if you enrolled in Medicare Part A on or after 1/1/2020, you cannot purchase this plan. Despite this restriction, plenty of excellent options are available to ensure you receive the quality healthcare you deserve without breaking the bank. Whether you’re looking for broad coverage, specialized care, or something in between, a Medicare plan is tailored to meet your specific needs.

So, suppose you want to enjoy the many benefits of comprehensive Medicare coverage without any added financial stress. In that case, we highly recommend you explore your options and choose the best plan for you. With Medicare Supplement Plan F or any other comprehensive plan, you can rest easy knowing that your healthcare costs are well taken care of, leaving you free to focus on what matters – living life to the fullest!

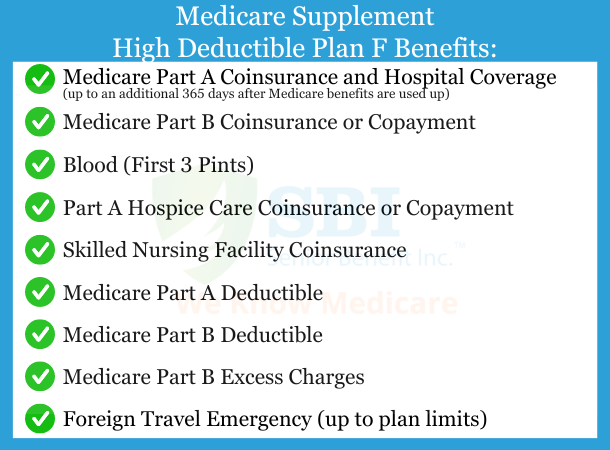

Understanding Medicare Supplement Plan High Deductible F

Medicare Supplement High Deductible Plan F offers the same comprehensive coverage as the traditional Plan F. However, in this plan, you will pay a deductible of $2,800 (2024) before the coverage begins. This plan is an excellent option for seniors looking for a budget-friendly Medicare Supplement option without compromising coverage.

Once you meet the deductible limit, the High Deductible Plan F covers all the required services throughout the year with no network limitations. You can choose any doctor or healthcare provider that accepts Medicare patients, and the plan will cover the same services as the traditional Plan F.

It’s important to note that this plan is not available to people who enrolled in Medicare Part A on or after 1/1/2020. If you meet that criteria, many other Medicare Supplement plans are available to choose from, providing you with the coverage you need.

The High Deductible Plan F is an excellent option for budget-savvy seniors who want comprehensive coverage while keeping their premium costs low. With its broad coverage and flexibility in selecting healthcare providers, this plan offers peace of mind for seniors who value their health and well-being.

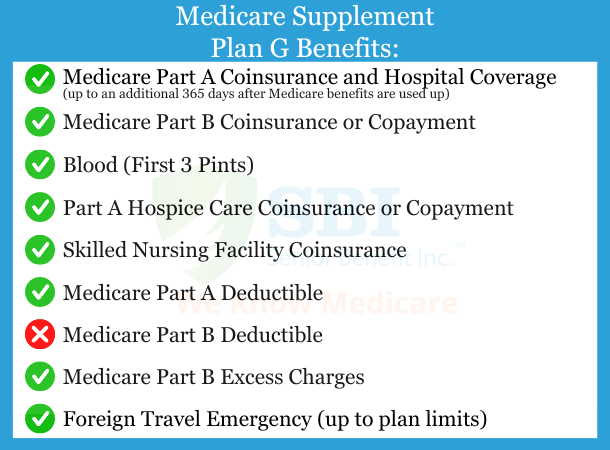

Understanding Medicare Supplement Plan G

Medicare Supplement Plan G is one of the most popular options for seniors who want comprehensive coverage and predictable healthcare costs. This plan offers all the benefits of Plan F except for the Medicare Part B deductible. However, once you meet this deductible for the year ($240 in 2024), your Plan G coverage kicks in, and there will be no out-of-pocket costs for covered services.

Plan G offers more coverage and flexibility than many other Medicare Supplement plans. With Plan G, you can visit any doctor or hospital that accepts Medicare, which means you have more options and greater control over your healthcare.

So, if you’re looking for a Medicare Supplement plan offering comprehensive coverage and predictable healthcare costs, Plan G is worth considering. With its generous benefits and flexibility, it’s a great way to protect your health and finances in retirement.

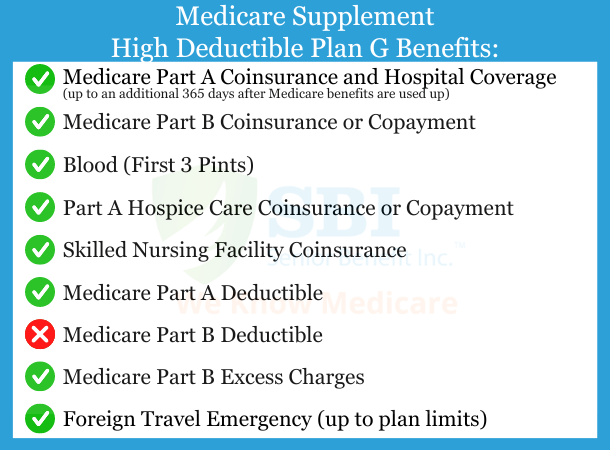

Understanding Medicare Supplement Plan High Deductible G

High Deductible Medicare Supplement Plan G is a comprehensive healthcare plan that offers the same coverage as Plan G. This plan is perfect for those who want to enjoy a range of healthcare services without worrying about unexpected costs. The plan works by reaching a deductible amount, which is set at $2,800 for the year 2024. Once this deductible is met, the plan covers all included services and treatments for the remainder of the year with no additional out-of-pocket expenses.

It is important to note that this plan does not cover the Medicare Part B deductible, which is included in the plan deductible. However, this plan may be an excellent choice for those willing to pay a higher deductible as it offers comprehensive coverage for all other healthcare services. Additionally, this plan doesn’t involve networks, which means any facility that accepts Medicare will also accept this plan.

In conclusion, if you are looking for a comprehensive, cost-effective healthcare plan that offers flexibility and peace of mind, a High Deductible Medicare Supplement Plan G may be just what you need. With its thorough coverage and affordable rates, this plan is an excellent choice for those who want to enjoy their golden years without worrying about unexpected medical expenses.

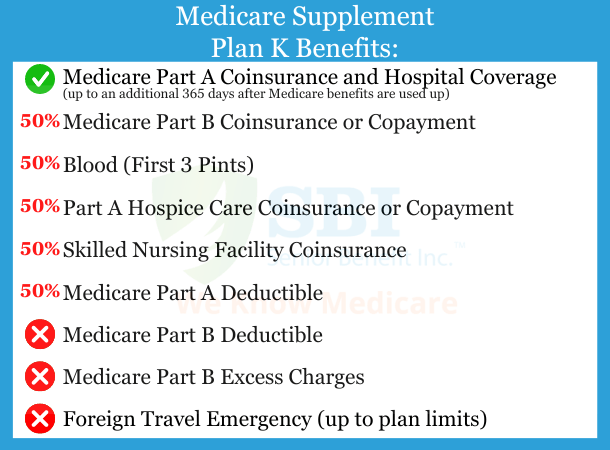

Understanding Medicare Supplement Plan K

Medicare Supplement Plan K is only offered by a few companies, but it can be a great plan because of the coverage and price. This plan has a maximum out-of-pocket deductible of $7,060 for 2024. Plan K covers 100% of your Part A coinsurance and hospital coverage. It also covers 50% of your Part B coinsurance or copayment, Part A Deductible, Part A hospice coinsurance or copayment, the first 3 pints of blood, and skilled nursing care.

Like all Medicare Supplements, this plan has no networks, so you can visit any doctor or hospital that accepts Medicare, which means you have more options and greater control over your healthcare.

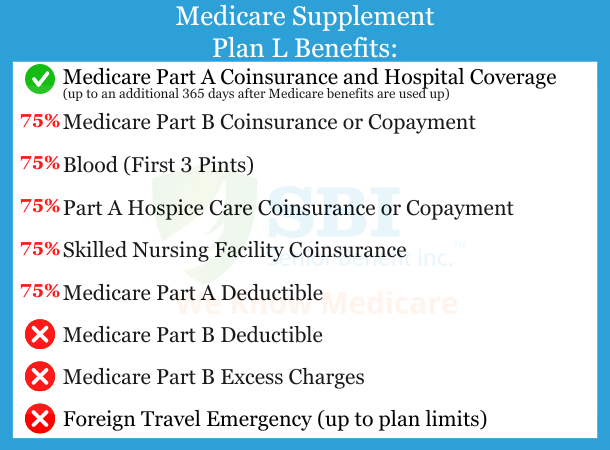

Understanding Medicare Supplement Plan L

Medicare Supplement Plan L is only offered by a few companies, but it can be a great plan because of the coverage and price. This plan has a maximum out-of-pocket deductible of $3,530 for 2024. Plan L covers 100% of your Part A coinsurance and hospital coverage. It also covers 75% of your Part B coinsurance or copayment, Part A Deductible, Part A hospice coinsurance or copayment, the first 3 pints of blood, and skilled nursing care.

Like all Medicare Supplements, this plan has no networks, so you can visit any doctor or hospital that accepts Medicare, which means you have more options and greater control over your healthcare.

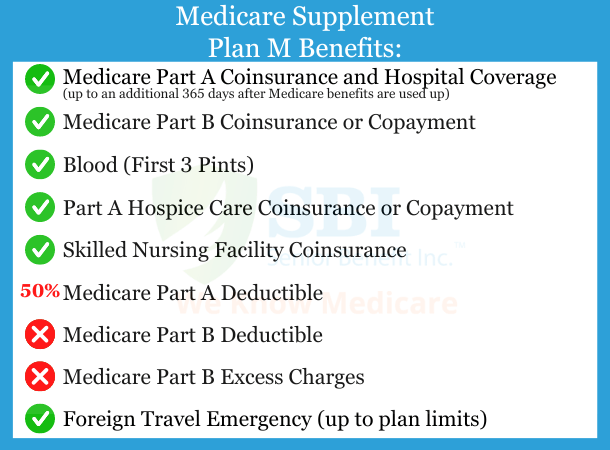

Understanding Medicare Supplement Plan M

Medicare Supplement Plan M is an excellent option for those seeking a cost-effective supplement plan. Compared to other supplement plans, Medicare Supplement Plan M offers the same benefits but a slightly lower monthly premium, which could save you a good amount of money in the long run. By choosing Medicare Supplement Plan M, you will be responsible for paying half of your Part A deductible. This plan doesn’t cover your Part B deductible or excess charges. This cost-sharing approach can significantly lower your monthly premium while providing comprehensive coverage. If you are looking for an affordable way to supplement your Medicare coverage, Medicare Supplement Plan M is undoubtedly worth considering.

In addition, Medicare Supplement Plan M has no networks, so any doctor who accepts Medicare will accept it. It’s an excellent choice for those who want the freedom to choose their healthcare provider.

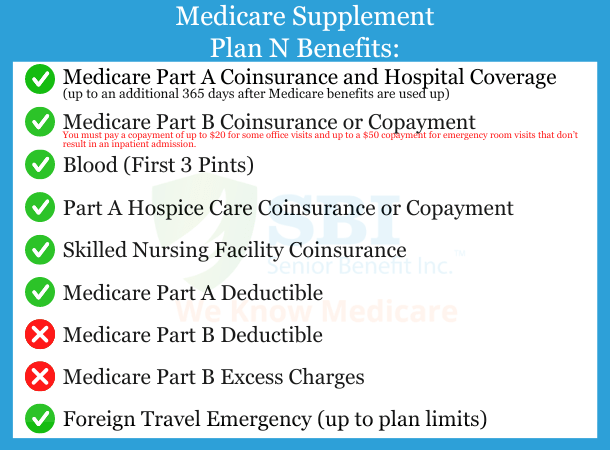

Understanding Medicare Supplement Plan N

Medicare Supplement Plan N covers a lot, but it’s important to note that it doesn’t cover everything. Unfortunately, this plan doesn’t cover the Medicare Part B deductible or excess charges. However, if you’re willing to pay a $20 copay for doctor visits and a $50 copay for emergency room visits, you can enjoy the benefits of this plan.

In addition, Medicare Supplement Plan N has no networks, so any doctor who accepts Medicare will accept it. It’s an excellent choice for those who want the freedom to choose their healthcare provider.