Medicare Part D

2025 Medicare Part D Changes

Starting January 1st, 2025:

Medicare Part D changes in 2025 in several ways, including a lower out-of-pocket drug cost limit, a redesigned benefit structure, and a new monthly installment payment option. These changes were made by the Inflation Reduction Act (IRA).

Lower out-of-pocket drug cost limit:

- The out-of-pocket drug cost limit for 2025 is $2,000

- Once the enrollee reaches this limit, they don’t have to pay a copayment or coinsurance for the rest of the year.

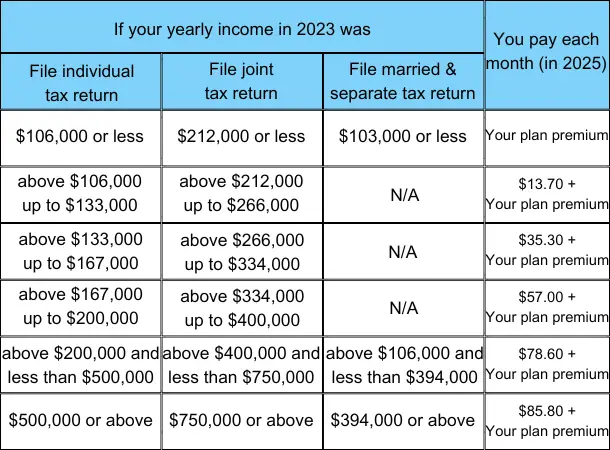

Medicare Part D IRMAA (Income-Related Monthy Adjustment Amount) is an additional premium that some Medicare Part D enrollees must pay. It applies to people with incomes above a certain threshold.

Medicare Part D is the prescription drug plan. You must have Part A and/or Part B to join a separate Medicare Part D prescription drug plan. Most people will pay a monthly premium for this coverage. Everyone with Medicare can get this coverage. It may help you lower prescription drug costs and help protect against higher costs in the future. Private companies provide the coverage. You choose the drug plan (there are many from which to choose) and pay a monthly premium. If you decide not to enroll in a drug plan when you are first eligible, you may have to pay a penalty if you join later.