Medicare Part B

2025 Medicare Part B Changes

Starting January 1, 2025:

- The standard monthly premium of Medicare Part B increased to $185/month in 2025. (Up from $174.90 in 2024).

- The annual deductible for Medicare Part B will be $257 per year in 2025. (up from $240 in 2024)

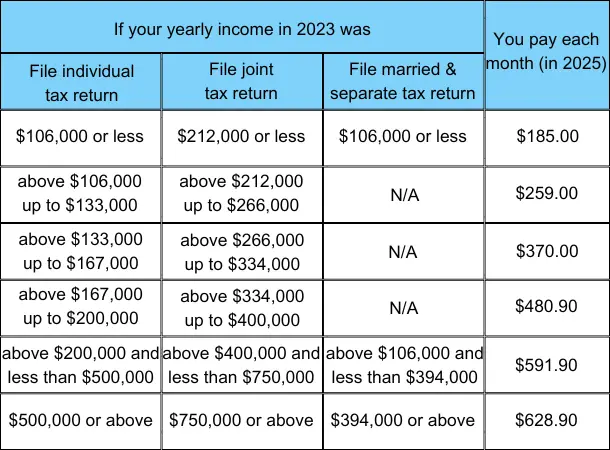

- Most people pay the standard monthly premium amount ($185). If your modified adjusted gross income, as reported on your IRS tax return from 2 years ago, is above a certain amount, you may pay an Income Related Monthly Adjustment Amount. The Income Related Monthly Adjustment Amount (IRMAA) brackets have been changed as follows:

Medicare Part B (Medical Insurance) Helps cover the following:

- Services from doctors and other healthcare providers

- Outpatient Care

- Durable Medical Equipment (like wheelchairs, walkers, hospital beds, and other equipment)

- Many Preventive Services (like screenings, shots, or vaccines, and yearly “Wellness” visits)

Medicare Part B (Medical Insurance) helps cover medically necessary doctor’s services, outpatient care, home health services, durable medical equipment, mental health services, and other medical services. Part B also covers many preventive services.

Additional services covered include:

- Ambulance services

- Ambulatory surgical centers

- Cardiac rehabilitation

- Emergency department services

If you’re enrolled in Original Medicare, it’s important to understand the costs you may be responsible for. If the Part B deductible applies, you are accountable for covering all the expenses (up to the Medicare-approved amount) until you meet the yearly Part B deductible. Once you meet your deductible, Medicare will pay its share, and you will typically pay 20% of the Medicare-approved amount (if the doctor or other healthcare provider accepts the assignment). It’s essential to remember that there’s no yearly limit on the amount you pay out of pocket if you have Original Medicare. However, if you have supplemental coverage like Medigap, Medicaid, employer, retiree, or union coverage, you may have limits on the expenses you pay. By being aware of these costs and your options for supplemental coverage, you can make informed decisions about your healthcare and avoid unexpected expenses.

If you do not sign up for Medicare Part B at the right time, you could be subject to a lifelong penalty.