Medicare Supplement High Deductible Plan F

Medicare Supplement High Deductible Plan F

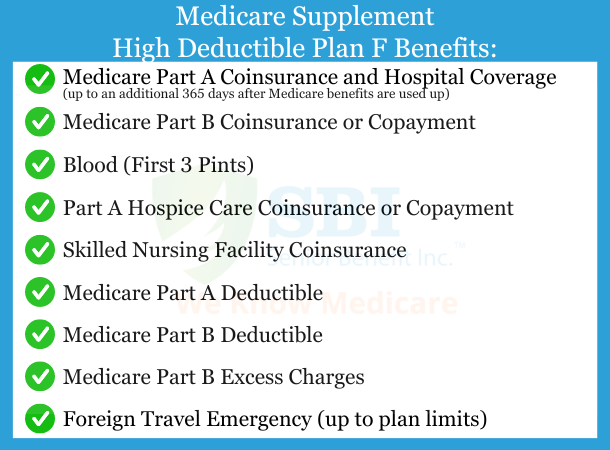

A Medicare Supplement High Deductible Plan F has coverage identical to a Plan F. Once the deductible of $2,800 (2024) is met, the plan pays 100% of covered services for the rest of the calendar year. And like all other supplements, this plan has no networks so that you can go anywhere Medicare is accepted. Remember, if you received Medicare Part A on or after 1/1/2020, you are not eligible to purchase this plan. (MACRA)